Rebooting Investment Management

Oriskany is a creator of quantitative investment strategies, using non-linear datasets and financial engineering to deliver robust, liquid, bespoke investments

Oriskany is a creator of quantitative investment strategies, using non-linear datasets and financial engineering to deliver robust, liquid, bespoke investments

Financial Markets are a complex system exposed to a radical form of Uncertainty, not to the mild randomness of Modern Portfolio Theory. They are non-ergodic, non-stationary, and as such must be viewed with the right lenses.

We view resilience as the ability of a strategy to endure, recover and be predictable. We believe it is the key objective of an Investment Strategy.

The overwhelming impact of data is no longer up for discussion, it is a given. The question becomes how to select, curate, transform and use data in order to create relevant Investment Strategies.

Sustainability goes beyond using mostly ESG-certified assets, which we do. By looking at long-term outcomes and focusing on robustness, we want to contribute to a more sustainable role for Investment.

More than just gimmicks, digitalisation and industrialisation must serve investors by allowing them to have their dedicated strategies. We have the ability to create bespoke strategies at scale.

Oriskany is a creator of quantitative investment strategies, using non-linear datasets and financial engineering

Our clients access these robust, liquid and bespoke strategies through actively managed certificate (AMC), swap, notes, funds and managed accounts

We work with wealth managers, family offices, insurance companies, pension funds, investment managers and corporate treasurers

Financial markets are a complex environment, but they have mostly been described by theories that postulate rationality, continuity, smoothness, and other unrealistic hypotheses

Today, investment and risk managers recognize the fragility of the procedures and tools they have been using and that are based on the Modern Financial Theory

These need to be revisited and improved in order to enhance robustness to shocks and agility in a complex environment

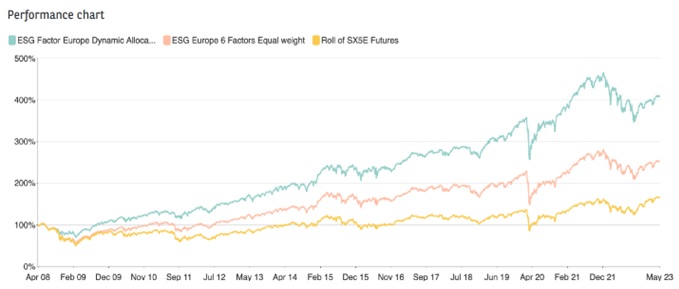

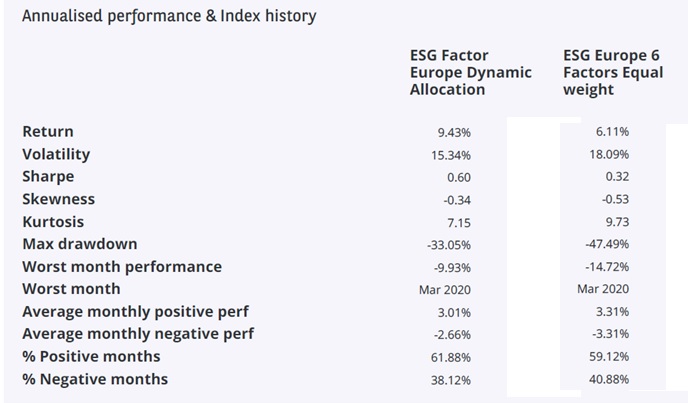

Please find below an example of strategy for one of our institutional client: a European ESG Dynamic Beta

Specifications:

Performance

Source BNP Paribas CIB

The value creation is spread throughout the life of the strategy and not clustered around a few good “bets”. Overall, with 90% average exposure, the strategy is able to capture most of the upside of a bull market.

Resilience – Controlled Drawdown

[Bouton Vers PDF?]

Source BNP Paribas CIB

Our risk filters are able to capture the increased probability of significant market pull-backs which leads to resilience and the ability to endure downturns. The drawdown is significantly reduced.

Resilience – Fast Recovery

Source BNP Paribas CIB

Because the strategy has controlled drawdowns, it displays on top of its ability to endure, the capacity to recover quickly.

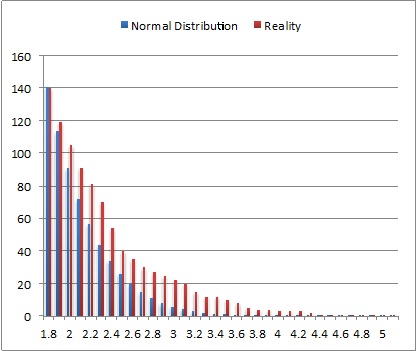

Resilience – Statistically Predictable

Source BNP Paribas CIB

The performance of the strategy is more linearly distributed and the negative tails are reduced when compared to the market, making the strategy easier to predict.

Myth 1: Financial markets are unpredictable, but over time things average out so it is best to diversify and then buy-and-hold.

The unpredictability of financial markets is summarized by the classic “random walk model”, which is based on 3 claims:

The first claim can be accepted, but data and common sense overwhelmingly contradicts the second and third.

For instance, a histogram of the daily returns of EUR-USD over 6 continuous years shows quite clearly that the bell curve does not hold: the actual number of daily moves of a given magnitude, expressed in numbers of standard deviations (red bars) is far greater than the number predicted by the Normal Distribution (blue bars). In practical terms, this means that extreme outcomes will occur far more frequently than the classical tools (such as VaR) expect. The consequences can obviously be dire…

The assumption of independence of returns from one period to the next is just as problematic. Intuition commands that today’s return on an equity index should have an influence on what happens tomorrow: if the index moved 10% today (up or down), tomorrow is likely to be a volatile day too because the market is nervous. Standard theory refutes this real-life common sense and thus hits a paradox: there might not be a correlation in the direction of the index movements (up doesn’t always follow up), but there is certainly dependence in the magnitude of those moves. Large moves tend to be followed by large moves, it is what B. Mandelbrot calls the “memory” of markets and it helps explain why volatility clusters.

The decision process of financial actors also contradicts the assumption of independence. Because the actions of investors have an impact on the information set they used to decide on these very same actions, a circular reference is created, which will mechanically introduce dependence in the succession of returns. This is what George Soros calls reflexivity.

In a nutshell, price changes do not follow a Random Walk, so it is best not to rely blindly on models that have this assumption at their core (Portfolio Theory, CAPM, Black-Scholes, GARCH models, etc…).

Myth 2: Expected returns and volatility are a good measure of the profile of a portfolio

Standard theory believes that Volatility effectively assesses risk (mean-variance framework of Markowitz). However, intuition and behavioural finance easily contradict this postulate. Indeed, the average stock-market return, around which volatility distributes the outcomes, is of little interest to the real investor, for whom the extremes of profits and especially losses matter much more. Additionally, behavioural finance studies have proven that for a given absolute variation, losses matter far more than profits.

More generally, standard theory has relied extensively on estimates of expected returns, volatilities and correlations to predict the risk of a portfolio. Consequently, this has given rise to the practice of “optimization”, which is a way of choosing the best possible allocations based on those estimates.

This is evidence of over-confidence, a well-known behavioural bias. The world is much more unpredictable than models expect, hence future estimates of volatilities and correlations are bound to be wrong (especially as the time horizon of the prediction lengthens). The optimal solutions are therefore optimal for only one state of the world, and will generally not be robust. Robustness, or the ability of being strong enough to withstand challenges, is much more important: it will determine that a portfolio can perform adequately whatever the environment. In other words, in the rough world of financial markets, it is a waste of resources to fine-tune a Formula 1, better build a robust four-wheel drive instead…

Myth 3: Markets are continuous

Standard theory postulates that quotes and rates do not jump but that they move smoothly from one value to the next. Continuity of this sort characterizes all (physical) systems subject to inertia; it is for instance how temperature moves throughout the day. Newton, Leibnitz, and later the economist Alfred Marshall all believed that “Nature does not make leaps” (Natura non facit saltum), and indeed the human mind is configured to assume continuity, which is a central assumption of MFT. The maths behind the works of Markowitz, Sharpe, Black-Scholes all assume continuity, and without it, the formulae simply do not work.

However, discontinuity and sudden change are everywhere on Financial Markets, from the movements of prices to the expectations of investors. That is where the difference between economics and classical physics is greatest: the supply and demand that determine a price are both functions of objective factors and anticipations. Even if we accept a continuous approximation for the former, the latter can change completely based on a signal that will take very little time and energy. Consequently, we should expect destabilizing jumps and phase transitions as a result.

Rather than applying buy-and-hold strategies that are incorrectly justified by normal distributions and continuous changes, investors are better off using Discontinuity to their advantage by investing in the market much more selectively.

Financial markets have an endogenous life, meaning that, in all places and ages, they work alike. Even if we could isolate the market from its environment completely, there would still be an inherent activity that comes from the way people come together, organize themselves and exchange assets. For instance, in a modeled world where only 2 categories of investors exist (fundamentalists and chartists) and no new information arrives, interactions and variations start to appear spontaneously and bubbles and crashes occur. This instability is intrinsic, and should not be viewed as a simple “deviation from the equilibrium”.

Source : Michel Baranger — Chaos, Complexity, and Entropy – A physics talk for non-physicists – Center for Theoretical Physics, Laboratory for Nuclear Science and Department of Physics Massachusetts Institute of Technology, Cambridge, MA 02139, USA and New England Complex Systems Institute, Cambridge, MA 02138, USA MIT-CTP-3112

Not complex!

The randomness in a casino is continuous and deterministic (“ergodic”), creating endogenous stability (“the House always wins”)

Complex!

The whole is more than the sum-of-the-parts, it is irreversible (once made, it cannot be unmade)

Not Complex!

The interactions between all parts are linear and deterministic, it is reversible (it can be made, then unmade, then made again)

Complex!

Multiple interdependencies, endogenous instability, succession of different phases (fluid or traffic jam), positive feedback loops (self-reinforcing effects)

REFERENCES:

The (unfortunate) complexity of the economy

Author : Jean-Philippe Bouchaud

Abstract : Jean-Philippe Bouchaud explains how physicists are bringing new ideas and methodologies to the science of economics.

Author : Naoise Metadjer

Abstract : This paper investigates whether we can detect certain universal features of complex systems approaching a regime shift to develop early warning indicators of financial crises. In particular, it presents evidence of nonlinear dependence structures, critical slowing down, and changing network topology in financial markets in the periods preceding financial crises.

An introduction to Econophysics – Correlations and Complexity in Finance

Author : Rosario Mantegna & Eugene Stanley

Abstract : This book concerns the use of concepts from statistical physics in the description of financial systems. Specifically, the authors illustrate the scaling concepts used in probability theory, in critical phenomena, and in fully developed turbulent fluids. These concepts are then applied to financial time series to gain new insights into the behavior of financial markets. The authors also present a new stochastic model that displays several of the statistical properties observed in empirical data.

Information et entropie. Un double jeu avec les probabilités (Document in French)

Author : Mathieu Triclot

Abstract : In 1948 Shannon and Wiener introduced a new measure of information in the field of communication engineering. In order to qualify the physical dimension of information, Cybernetics took over this measure and built an analogy between information and entropy. This article compares two versions of the analogy, in Wiener and Brillouin’s work. It suggests that the divergence arises from the dual interpretation, belief or frequency-type, of the probabilities used in the information definition. The concept of information quantity thus appears as an unstable mix of belief-type and frequency-type elements of probability.

The Role of Entropy in the Development of Economics

Author : Aleksander Jakimowicz

Abstract : The aim of this paper is to examine the role of thermodynamics, and in particular, entropy, for the development of economics within the last 150 years. The use of entropy has not only led to a significant increase in economic knowledge, but also to the emergence of such scientific disciplines as econophysics and complexity economics.

Econophysics: Financial time series from a statistical physics point of view

Author : Vasiliki Plerou, Parameswaran Gopikrishnan, Bernd Rosenow,Luis A.N. Amaral, H. Eugene Stanley

Abstract : In recent years, physicists have started applying concepts and methods of statistical physics to study economic problems. The word \Econophysics” is sometimes used to refer to this work. Much recent work is focused on understanding the statistical properties of financial time series. One reason for this interest is that financial markets are examples of complex interacting systems for which a huge amount of data exist and it is possible that financial time series viewed from a different perspective might yield new results.

Author : Sheila C. Dow

Abstract : The uncertainty which has characterised the financial crisis has encouraged renewed attention to uncertainty in economics. Yet, not only is uncertainty seen as unpalatable in financial markets and economic life more generally, it also poses challenges for economists to the extent that uncertainty is absent from most of mainstream theory.

20 years’ experience dealing with Institutional Investors across Europe

Generated several mio€ in yearly P&L with Investment Solutions, Structured Derivatives, Quantitative Research.

Graduate of the London School of Economics; Sciences Po Paris; CFA Charterholder

20+ years’ experience as Fund Manager (Managing Portfolios of 2bn€+), UHNW Private Banker, Fund Selection with leading Luxembourg Banks (ING Luxembourg, SGBT, CBP Quilvest). Graduate of Sciences Po Strasbourg

Oriskany is a small village in Oneida County, New York State in the United States of America. The name is derived from the Iroquois word for “nettles” These plants are famously itchy, serving as a reminder that our core philosophy is stinging and unsettling, because it is innovative. As of today, the ideas of Complexity and Discontinuity are still not fully mainstream on Financial Markets and more generally in the business community.

Oriskany is better known for a battle that was fought there in the 18th century. This event is a great illustration of the butterfly effect, where a seemingly small cause can have major consequences.

Oriskany is a small village in Oneida County, New York State in the United States of America. The name is derived from the Iroquois word for “nettles” These plants are famously itchy, serving as a reminder that our core philosophy is stinging and unsettling, because it is innovative. As of today, the ideas of Complexity and Discontinuity are still not fully mainstream on Financial Markets and more generally in the business community.

Oriskany is better known for a battle that was fought there in the 18th century. This event is a great illustration of the butterfly effect, where a seemingly small cause can have major consequences.

The battle of Oriskany took place on August 6th, 1777 and is a great illustration of the discontinuity and non-linearity encountered in real life, and in particular in the military field.

Fort Stanwix was besieged by a force of British troops, supplemented by American Loyalists, Hessian and Indian contingents.

A relief force was organized by the Patriots, but the British detected the column and sent a party to ambush them at Oriskany Creek.

The Patriots were repelled with heavy losses and it seemed the British had won the day.

However, while the British were fighting at Oriskany, the occupants at the fort used the reduction in the force before them as an opportunity to sally out and sack the British camp.

Hearing the news, the British troops returned in a hurry from Oriskany, leaving the battlefield to the Patriots.

They arrived at a camp that had been stripped of much, including personal belongings, especially the blankets the Indians slept in.

Combined with the fact that the battle at Oriskany had cost so many Indian lives, this greatly upset the Indians.

They had been told that the “white men”, who had thus far fought relatively little, would do most of the fighting. In fact, the British victory at Oriskany was more than offset by the discontent of the Indians.

This breach of trust damaged relations between the two allies and became a reason in the eventual later failure of the siege of Fort Stanwix.

The failure to capture Fort Stanwix contributed to the massive British surrender following the Battle of Saratoga in October 1777.

Saratoga was the turning point of the American War of Independence as this American victory was instrumental in formally bringing France into the war as an American ally.

Small deeds can have massive consequences…

The high “sensitivity to initial conditions”, a defining feature of Complex Systems, is also illustrated in this famous poem attributed to Benjamin Franklin, another key actor of this era:

For want of a nail the shoe was lost.

For want of a shoe the horse was lost.

For want of a horse the rider was lost.

For want of a rider the message was lost.

For want of a message the battle was lost.

For want of a battle the kingdom was lost.

And all for the want of a horseshoe nail.

Benjamin Franklin

Oriskany is also the name given to a warship of the US Navy. This ship is famous for its post-service history as it became an artificial reef for sea wildlife. Such a transformation caught our imagination.

To honour this battle, the US Navy commissioned an aircraft carrier that would become the USS Oriskany (CV/CVA-34) – nicknamed “Mighty O”.

She operated primarily in the Pacific and served during the Korean and Vietnam Wars.

USS Oriskany’s post-service history differs considerably from that of other US Navy ships.

Usually, a former ship would be sold for scrap, but it was decided to sink Oriskany as an artificial reef off the coast of Florida in the Gulf of Mexico.

After much environmental review and remediation to remove toxic substances, she was carefully sunk in May 2006, settling in an upright position at a depth accessible to recreational divers.

The Oriskany is one of the largest vessels ever sunk to make a reef and contributes to the richness of the marine environment where she lays.

The transformation of an instrument of warfare into a constructive item is indeed possible and such a transformation caught our imagination.

Likewise, Finance needs to become once more an instrument in favour of the greater good and not the economic weapon of mass destruction that it can become, through reckless and predatory attitudes.

Finally, risk considerations are at the core of everything we do. This obsession with risk management therefore appears in our name, which can be read O-risk-any, or “0 Risk Any”…

Meteorology is a great example of a Complex System: it is highly dynamic and non-linear.

So, is there any better physical representation of what we believe at Oriskany than a turbulence?

Indeed, the turbulence sums it all, as this small-scale, irregular air motions are characterized by currents that vary in speed and direction and see their energy being described by non-linear laws.